Advanced Review Portfolio for 68174326, 662999212, 799361078, 120941137, 8445542158, 8332008608

The Advanced Review Portfolio presents a meticulous examination of six distinct identifiers. Each asset is evaluated through performance metrics, risk assessments, and strategic insights. This structured approach aims to highlight both strengths and weaknesses. Stakeholders may find the insights particularly useful in navigating market dynamics. However, the implications of these findings raise questions about adaptability and long-term strategies in a fluctuating economic landscape. What conclusions can be drawn from this comprehensive analysis?

Overview of Key Identifiers

Key identifiers serve as essential markers that facilitate the categorization and analysis of various elements within a portfolio.

They enhance data accuracy by ensuring that each component is distinctly recognized and correctly represented.

In this context, key identifiers play a crucial role in streamlining processes, enabling stakeholders to make informed decisions while maintaining clarity and precision in their assessments and evaluations.

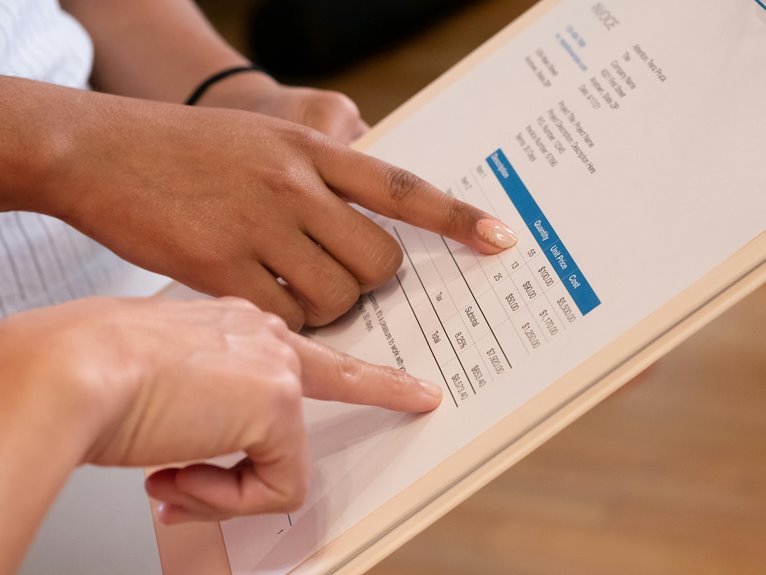

Performance Metrics Analysis

Performance metrics serve as vital benchmarks for evaluating the effectiveness and efficiency of a portfolio’s components.

By analyzing performance trends, stakeholders can identify strengths and weaknesses within individual assets. These insights allow for informed decision-making, ensuring alignment with strategic objectives.

Metric benchmarks facilitate comparisons against industry standards, enhancing the overall understanding of performance and guiding future investment strategies toward greater autonomy and success.

Risk Assessment and Management

While the potential for returns often drives investment decisions, a comprehensive risk assessment and management strategy is essential for safeguarding assets and ensuring long-term portfolio stability.

Effective risk mitigation involves identifying vulnerabilities and implementing compliance strategies to adhere to regulatory standards.

This proactive approach enhances resilience against market fluctuations, ultimately fostering a secure environment for investment growth and protecting stakeholders’ interests.

Strategic Insights and Recommendations

Given the complexities of today’s financial landscape, developing strategic insights and recommendations is crucial for informed investment decisions.

A thorough competitive analysis should be conducted to identify market trends that can influence portfolio performance.

Investors are encouraged to remain agile, leveraging data-driven insights to navigate fluctuations and capitalize on emerging opportunities, ultimately fostering a more resilient and profitable investment strategy.

Conclusion

In summary, the Advanced Review Portfolio for the specified identifiers provides a detailed framework for assessing asset performance and risk. By maintaining a finger on the pulse of market trends, stakeholders can navigate uncertainties with confidence. The insights gleaned from the analysis allow for well-informed strategies that not only protect investments but also position them for future growth. Ultimately, this portfolio equips investors to weather the storm and seize opportunities as they arise.